Let’s talk about annual maximums.

The difference between an annual maximum and a deductible is arguably the most significant distinction between a typical dental insurance plan and a typical medical insurance plan, especially when it comes to your wallet.

It is important to note that many of the aspects of dental and medical coverage discussed in this article do not pertain to Medicaid insurance. Medicaid insurance operates differently (even though in North Carolina it does cover medical and dental, for children AND adults). We will discuss Medicaid specifically in a future post.

Additionally, this blog post should not be taken as medical or dental advice. When considering personal care and the cost of that care, consult your provider and insurance company to ensure that you fully understand all costs associated with different treatment options.

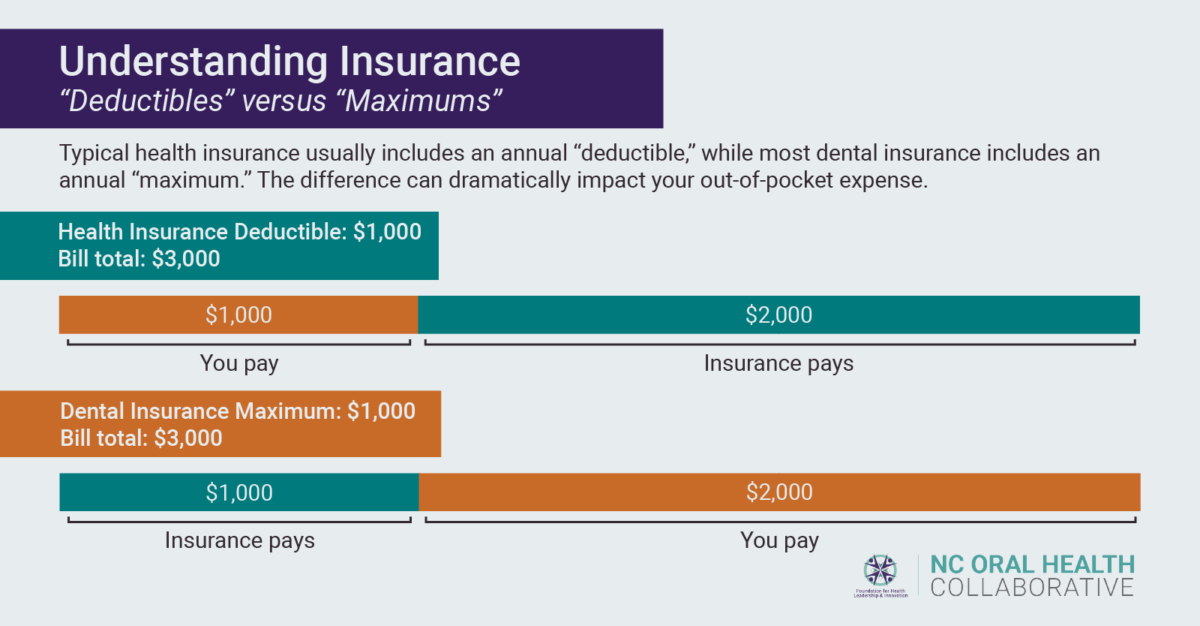

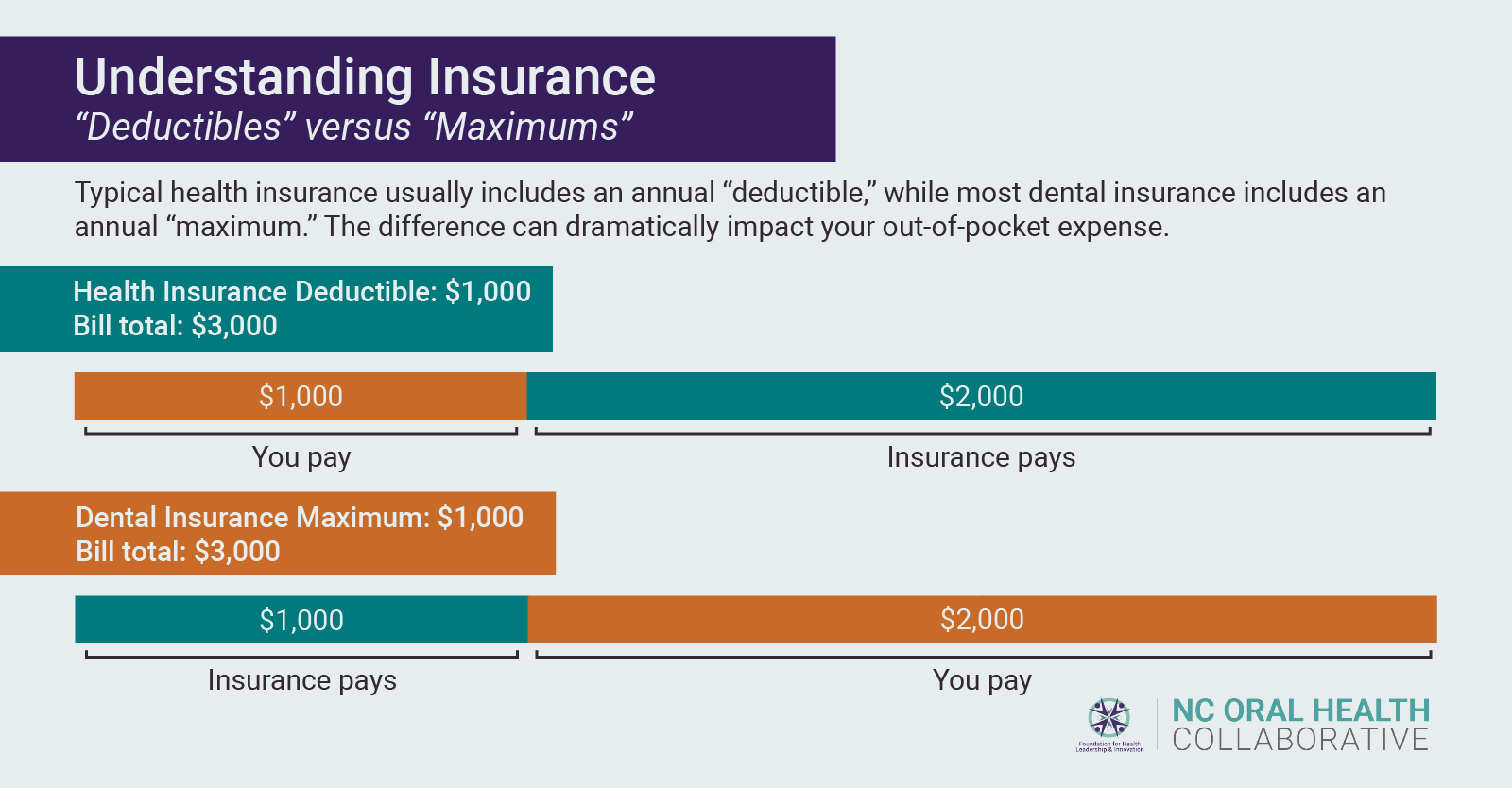

A traditional medical insurance plan usually includes what’s known as a deductible. If your deductible is $1,000, for example, once you reach $1,000 in out-of-pocket medical expenses (meaning dollars that you, not your insurance company, pay for covered medical procedures), your insurance company pays 100 percent of in-plan procedures for the rest of your annual insurance period.

Dental insurance generally works in the opposite manner. Most dental plans have “annual maximums,” not deductibles. With a maximum of $1,000, once you reach $1,000 in expenses that the insurance company has paid, you as the individual are responsible for 100 percent of your oral health care costs for the remainder of the contract year.

If you were to enroll in a dental insurance plan today, it may look something like this:

| Services | Coverage |

|---|---|

| Type 1, Preventive Oral exams (1 per 6-month period) Cleanings (1 per 6-month period) Bitewing x-rays (1 per 12-month period) |

100% covered by insurer, up to contract year maximum |

| Type 2, Basic services Fillings Full mouth x-rays Periodontal maintenance Injection of antibiotic drugs |

80% covered by insurer, up to contract year maximum |

| Type 3, Major Services Endodontics Anesthesia Simple and Surgical Extractions Oral Surgery Periodontics and Periodontal Surgery Crowns Inlays/Onlays Dentures Bridges |

50% covered by insurer, up to contract year maximum |

| Annual Contract Year Maximum | $1,000 |

On first glance, the tiered system of dental insurance clearly incentivizes regular preventive care. This is good, because nearly all dental disease can be entirely prevented, and regular visits to an oral health care provider are important steps in warding off cavities and gum disease.

On the other hand, however, what happens when you do experience more serious dental issues? Take a scenario where an old cavity filling fails, a new cavity forms underneath the failed filling, and you now need a root canal.

A single root canal on average will cost between $700 and $1,400, depending on the tooth requiring treatment and varying by location and provider. Once you receive a root canal you will also need a crown — an additional $800 – $1,500, depending on the crown material.

Say you end up right in the middle of those cost ranges: $1,050 for the root canal and $1,150 for the crown. Both are Type 3 procedures under the hypothetical insurance coverage above, meaning the insurance company will pay for 50 percent and you will be responsible for the other 50 percent. For both procedures, the total cost would be $2,200.

But don’t forget the annual maximum. The insurance company only pays $1,000 (assuming no other costs have been paid by the insurance company prior to your root canal) and you would be responsible for the additional $1,200. And if you need any other work done for the rest of the contract year, you will pay 100 percent of the cost.

That is a large out of pocket cost for someone who has insurance!

Unfortunately, the solution is not as simple as increasing the amount an insurance company pays for. More extensive policies would cost more and would quickly become more expensive than would make sense for most individuals who do not experience severe oral disease.

Dental insurance poses a complex question — how do we keep insurance costs low enough to incentivize people to: 1) get insurance; and 2) use that insurance to receive regular care, without leaving those with more severe needs hanging out to dry?

On the other hand, how do we create a structure where people with severe needs can see those needs met without crippling bills, while simultaneously keeping costs low for preventive care?

Neglect absolutely leads to tooth decay, gum disease, and eventually more expensive treatments. Some may argue that you reap what you sow, but those of us at NCOHC believe that everyone, with no exceptions, should be able to access quality, affordable oral health care.

It is also important to consider the fact that people can end up with severe dental needs by no fault of their own. In a case like mine, your loyal NCOHC blog author, you could end up on the wrong end of a golf club in high school and need years of surgeries and restorative work to get your two front teeth back.

My case is an example of the stark difference between dental and medical insurance. I was fortunate enough to have great medical insurance through my mother’s state employee health plan, which at the time included a clause for “accidental dental” needs (an uncommon clause in medical insurance). All of my countless dental visits for root canals, bone grafts, restorative work, surgeries, implants… (the list goes on and on) were entirely covered by medical insurance once we reached our deductible.

Our luck was rare. If all of that work had instead been covered by dental insurance, which would be the common scenario, we would have paid tens of thousands of dollars after reaching our $1,000 annual maximum.

At NCOHC, we are curious about your thoughts as a reader. We truly believe that solutions to the biggest problems will be discovered through collaboration, and we want you to be a part of it! Have an idea, a thought, or a question about the future of dental insurance? Click here and let us know!

NCOHC is a program of the Foundation for Health Leadership & Innovation. To get involved, find out more information, and to stay up to date, head over to NC4Change to sign up for our newsletter and see what events and other opportunities are on the horizon.